What is Zoom ?

For several years, and in particular, since the arrival of the health crisis and the various periods of confinement that have led to the generalisation of teleworking, the platform has experienced significant growth. Revenue was $2.56 billion in 2021, an increase of 54% over the previous year. Zoom is more often used by professionals, however, it can also be used by individuals. In addition to video conferencing, the group also offers an instant messaging service and content sharing. Before Covid 19, few people knew of the existence of Zoom, which saw its notoriety boosted in the space of just a few weeks. Today, the group is worth more than 115 billion dollars on the stock market and generates a profit of 671 million dollars. Its main competitors are Skype, which is part of the Microsoft team, but also Facebook and WhatsApp. Zoom also has more than 300 million participants per day, and more than 100,000 schools and universities use it on a regular basis. The site has 13 million so-called active users who can benefit from 40 free minutes for groups of no more than 100 people. The rates are around 19 euros per month for unlimited access and the use of additional features. Finally, the platform has 265,400 client companies.

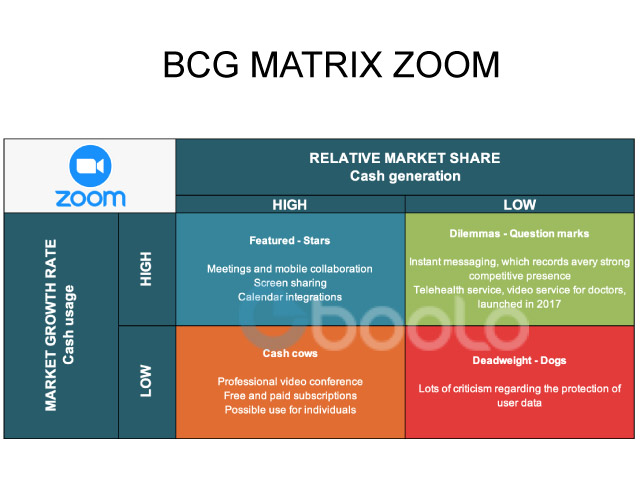

BCG Matrix Explanations

The BCG matrix makes it possible to highlight the services resulting from the Zoom platform. It classifies them into four categories, defined along two axes, which are the market growth rate and the relative market share. This tool allows the company to define a more effective marketing strategy by knowing its products and/or services better and investing where it is most relevant.

Star products

Thus, with regard to the Zoom platform, the star products are those that have a large market share in a market with strong growth. These services are mobile meeting and collaboration, screen sharing, and calendar integration. These services continue to require investment, but they are in a dominant position, so they are relatively profitable. These services will generally be future cash cows.

Cash cows

The cash cows are professional video conferences (and for individuals), free and paid subscriptions. These services are the most profitable for Zoom. They have started to gain importance with the emergence and generalisation of teleworking in the vast majority of companies following the multiple confinements in 2020. The services have a strong competitive intensity in the market that is growing slowly. The cash they generate is used to finance other services, new features that are often categorised as a dilemma.

Dilemmas

The dilemmas are in a situation of low penetration in a market that is nevertheless growing quite strongly. In the case of Zoom, it is instant messaging and telehealth service. These two services have a real intensity in terms of competition since the first is in direct competition with WhatsApp, Facebook Messenger, or even Skype, and the second with Doctolib. It is, therefore, more complicated to gain a dominant position in the market, and differentiating yourself from the competition is something that remains relatively complicated. The company must therefore determine what its long-term profitability is and decide whether the services will become star products or dead weights.

Deadweights

There is no dead weight on the Zoom platform. Nevertheless, it is possible to highlight the difficulties that the service may have encountered concerning the protection of user data. Indeed, security plays an increasingly important role for Internet users, and all the more so when it comes to seducing companies that have sensitive data. The competition is high enough to be able to jeopardise the platform in the event of recurring problems.

Conclusion

If the Zoom platform was generally little known before Covid 19, it has gradually acquired real notoriety that positions it as the main competitor of other sites such as Skype, Microsoft Teams, or even WhatsApp or Messenger. The platform's BCG matrix highlights which services are most successful and why. In addition, it also makes it possible to determine the liquidity needs for the services in question. This strategic tool can be supplemented by the SWOT matrices or Porter's five forces in order to put in place an ever more competitive vision of the group in the long term.

REFERENCES

https://www.lesnumeriques.com/pro/zoom-depasse-le-milliard-de-dollars-de-chiffre-d-affaires-mais-ralentit-n167683.html#:~:text=Au%20deuxi%C3 %A8th%20quarter%20of%20its,of%2054%20%25%20in%20annual%20slip.

https://fr.statista.com/infographie/21917/turnover-zoom-video-communications/