Louis Vuitton is arguably the most valuable luxury brand globally at a value estimated at over 500 billion dollars. This brand is managed by Louis Vuitton Moët Hennessy (LVMH), a European firm that envisions providing elegant and creative luxury products to its customers. The core business of this corporation falls under five categories: wines and spirits, watches and jewelry, perfumes and cosmetics, fashion and leather goods, and distribution and other company activities. Considering the value of this firm, it is vital to appraise the strategies the company has adopted to sustain its growth and remain competitive.

International Marketing Analysis - Louis Vuitton

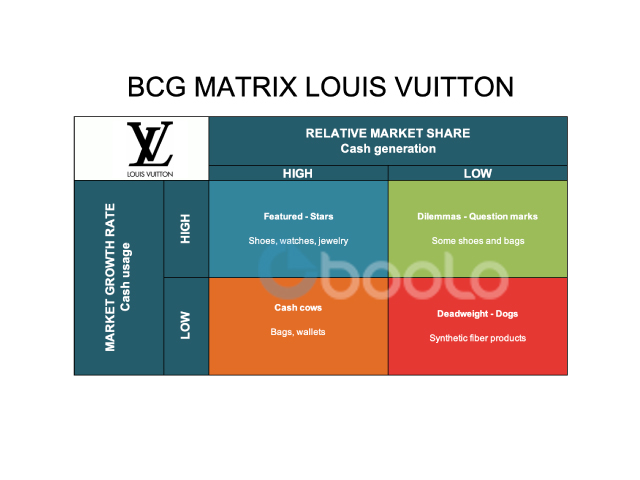

BCG Matrix and the Four Components

The BCG matrix is a tool developed by Boston Consulting Group that helps in the analysis of a firm’s products to establish their significance to that company. It is grounded in the theory that by understanding the position of a company’s products in the market, it is then possible for businesses to strategize their growth strategy. This tool is particularly useful as it may help the company to decide whether to increase its investment in a particular product category or dismiss it altogether (3). Two key aspects are considered under each category: market share, which refers to whether a product has a low or high market share; and market growth, which constitutes the potential customers in a market and whether that product can grow or not. The matrix has four divisions premised on an examination of market growth and market share.

The different types of business strategies

Stars

This category indicates that the firm will be able to attain a significant market share in a fast-growing market. Usually, this quadrant is considered as constituting the best opportunities for the growth of the company. In addition, the company will be known for being the leader in the business, although this does not necessarily imply that there is no need for promotion. As such, it is anticipated that the firm will invest a lot of resources to support the strong market share. In addition, products in this category require huge investments as a result of the significant growth rate. The advantage is that they are also known for generating a large profit from their business. For Louis Vuitton, the products that have generated the highest return on investment (ROI) and are considered star products include shoes, watches, and jewelry.

Cash Cows

In the occurrence that the market share grows exponentially and the sector matures, then the rate of market growth will decline, and the star transforms into a cash cow. Although the company has a large market share for products in this category, the industry's growth rate is significantly slow. The reason why they are termed cash cows is that they are known for generating cash above the needs, which results in a situation where they are milked (4). Since such products require little investment, the cash generated can be utilized to invest in other products and services. The performance of products in this category depends on whether the firm can achieve a competitive advantage. If that is achieved, the company enjoys high-profit margins and a huge cash flow. Some of Louis Vuitton’s cash cow products include its bags and wallets, which the company has attained a large market share but there is slow growth. Louis Vuitton should keep on investing the revenue generated from products in this category to support other segments that have higher rates of growth.

Question Marks

Also termed as children, question marks represent business segments that have a small market share despite there being a high rate of growth in that particular industry. Usually, such products do not intend to generate a lot of cash from that sector. Practitioners term them as question marks since the company will have to decide whether to approach the market by adopting a rigorous strategy or to sell them. The products in this segment are known for having high demand, but the profits earned are limited due to the limited market share. This implies that the organization will have to invest a lot of resources to gain a substantial market share. In most cases, competing firms will attempt to introduce new goods to attract consumers, but there is no particular strategy that has been selected for this sector. Interestingly, most businesses begin as question marks. Under this category, Louis Vuitton developed various products in the past before the company became popular with its popular brands. For instance, it attempted to introduce shoes and bags, but they have remained as question mark products due to their low market share.

Dogs

Dogs represent business units that have weak market shares and slow market growth, which may sometimes be because the industry has matured. Products in this category do not have the potential to generate huge profits and they do not also consume significant amounts of capital. Essentially, this implies that they have weak internal and external positions. Companies are usually advised to avoid products in this segment and instead use their resources to turn question marks into stars (4). Louis Vuitton’s synthetic fiber products business segment constitutes a dog as the market for such products has declined over the past several years. This has translated to losses for the company, and its market share in this sector remains low. The recommended approach for the firm is to invest its resources into other business units.

Conclusion

The BCG matrix is an effective tool that helps firms in analyzing their portfolio of products and make relevant decisions based on market share and growth rate. Based on this analysis, it is recommended that Louis Vitton should continue using the money generated from the cash cow products to support the star products. In addition, there is a need for investment in question mark products as these have the potential to become stars and generate more profit for the company. However, it is still important to conduct further analyses to predict the future of the industry and the skills and resources that Louis Vitton needs to dominate other markets.

Pellenc company strategy - SWOT analysis, Porter's 5 forces, BCG Matrix, and McKinsey Matrix

Conceptual models in strategic management: The Boston Consulting Group growth / share matrix